Contenidos

Planes de pensiones irpf

Santander pension login

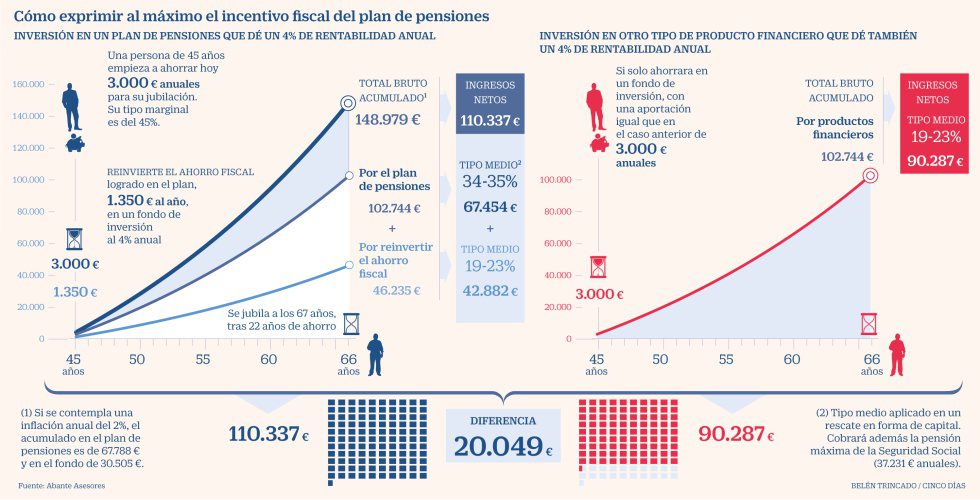

The most common thing when taking out a pension plan is to think about how much you are going to save on your tax return with your contributions. The reality is that pension plans pay taxes, and a lot of them compared to other products such as investment funds.

With a mutual fund, the way it is withdrawn has no influence on its taxation. With a pension plan the same does not happen and the difference can be thousands of euros in taxes. What’s more, choose wrongly how you recover your pension plan and you can squander the benefits of the best plan only in taxes.

Are you lost and don’t know how to do it? In these cases, the best option may be to turn to a financial advisor to help you with your finances and guide you on the best way to make your pension plan profitable.

If you want to get an idea of the tax withholding for surrendering a pension plan, you can use this surrender simulator, which will tell you how much tax you pay for surrendering the plan in the form of capital or in the form of income. The tool is very simple and in a few seconds you will know at a glance how much tax you will pay for recovering your retirement savings.

Santander pensiones sa egfp

El Grupo Catalana Occidente, promotor de los fondos de pensiones que ofrece Seguros Catalana Occidente, sigue criterios de inversión socialmente responsable, con un compromiso a largo plazo con la sostenibilidad de las políticas de inversión que provoquen un impacto positivo a la sociedad y al medio ambiente, y quiere consolidar progresivamente una línea de actuación que avance en este sentido.

Los fondos de pensiones del Grupo Catalana Occidente tienen en cuenta criterios extrafinancieros para el control, medición y gestión de los riesgos en las decisiones de inversión de la cartera de inversiones. Por ello, se incluyen criterios de inversión socialmente responsable en la política de inversión de los fondos.

Rescatar plan de pensiones

Planes de pensiones:Entidad gestora: Santander Pensiones, S.A. EGFP; Entidad depositaria: Caceis Bank Spain, S.A.; Promotor: Banco Santander, S.A. El KIID (Documento de Datos Fundamentales para el Inversor) está a su disposición en

2. Promoción válida desde el 1 de octubre hasta el 31 de diciembre de 2021, ambos inclusive. Podrán participar en esta promoción todas las personas que se adhieran mediante la firma del correspondiente formulario de solicitud. Las condiciones y requisitos para percibir las correspondientes bonificaciones, Planes de Pensiones y PIAS son independientes entre sí, y cada promoción requiere la firma de un formulario de solicitud independiente. Bonificaciones del 6% por un importe igual o superior a 100.000 euros condicionadas a mantener los planes abiertos durante 8 años.Para obtener la bonificación por traspaso de su Plan de Pensiones, sólo serán válidos los traspasos desde entidades ajenas al grupo Santander.

Promoción aplicable a los planes de pensiones promovidos y comercializados por Banco Santander S.A., Entidad Gestora: Santander Pensiones EGFP S.A. y Entidad Depositaria: Caceis Bank Spain, S.A., Entidad Promotora: Banco Santander, S.A. Puede consultar el DDFP de cada plan de pensiones en santanderassetmanagement.es.

Santander pension contact number

A pension plan is a long-term savings instrument with two different types of taxation. On the one hand, there is the taxation corresponding to the contributions made, which entails tax benefits. On the other hand, there is the taxation of the redemption of the pension plan, which is different.

The taxation of the redemption of a pension plan is basically the opposite process to that of the contributions. When a pension plan is surrendered, the funds obtained are considered as earned income and, as such, they increase the taxable base of the IRPF causing an increase in the taxes to be paid.

The large increase in taxes involved in redeeming the plan all at once, makes the option of redemption in the form of an annuity become relevant. Let us suppose that the beneficiary of the pension plan agrees to receive €1,000 per month from the funds available in his plan. In this way, he will only have to add €12,000 per year to his general taxable income.

To finish balancing the taxation of the redemption of a pension plan, it is necessary to take into account the reduction of 40% of the funds redeemed from the pension plan in the form of capital. In 2007 this reduction was eliminated, but a transition period was established allowing the reduction of the amounts contributed to the plan before January 1, 2007.