Cartera permanente renta 4

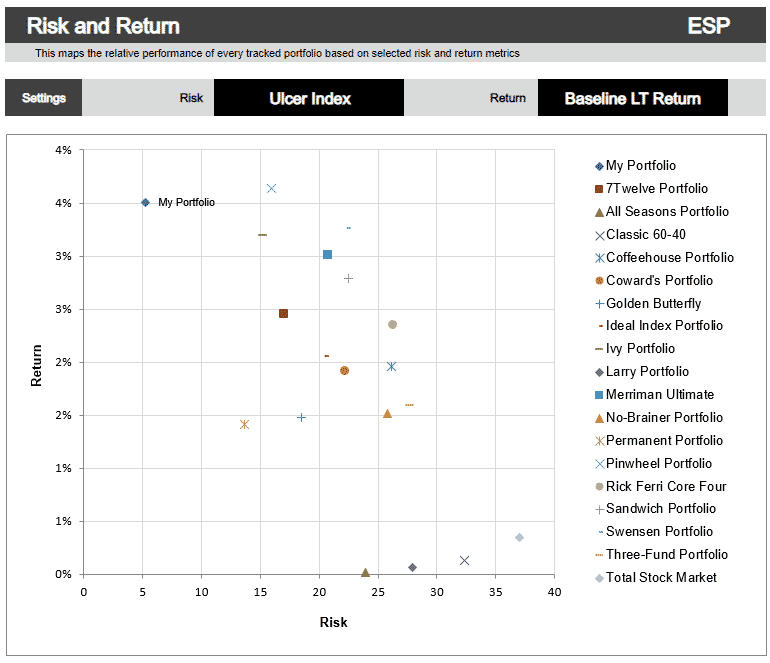

Permanent portfolio vs. golden butterfly

This data is indicative of the fund’s risk and is calculated based on simulated data which, however, may not be a reliable indication of the fund’s future risk profile. In addition, there is no guarantee that the category indicated will remain unchanged and may change over time.

In mathematics, the singularity occurs at a point where the function is not defined. Similarly, in technology, the singularity is the point at which the «brainpower» of machines will surpass the human being. These companies are working on the development and expansion of Artificial Intelligence.

This portfolio invests in leading global technology companies that also demonstrate a sustained and clear ability to deliver high dividend returns to investors. Much lower volatilities and earning dividend yields well above their sector average.

Bitcoin and other cryptocurrencies have discovered the potential of Blockchain technology, set to revolutionize the digital assets of the future. However, all technological revolutions need an infrastructure on which to develop. These companies offer exposure and gain value as blockchain technology appears in more and more projects. Investors seeking exposure to the potential of this technology but do not want the risks and volatility of cryptocurrencies find with this portfolio the element to join this investment factor, with portfolio diversification and the characteristics of equities.

Permanent portfolio without gold

The purpose of this article is to present a proposal for a new investment fund based on Harry Browne’s Permanent Portfolio on which I am working and for which I have committed a seed capital of 1M€.

If you are convinced that you would like to invest in this new vehicle in the future you can complete the following questionnaire which will ask for your name, email address and the amount you estimate you would invest initially. If you have problems with the form you can also send an email directly to [email protected].

To try to achieve such a complicated objective we need, in addition to an adequate asset allocation to survive any economic climate, to use tactical strategies that allow us to adapt to all types of market environments to protect us from the strong drawdowns or periods of maximum loss associated with strategies that, given their bias towards equities, are more exposed to these risks.

The Permanent Portfolio is a strategy well known to many individual and professional investors. In this report I will discuss the origin of the strategy, the fundamentals that make it a solid strategy for the future, and present my proposal in UCITS mutual fund format.

Permanent portfolio etf

What are the largest technology companies in the world? In this portfolio are the companies with the largest capitalization in the sector, and those with the greatest potential to be market leaders. As of today, the companies known as FAANG, but removing Netflix and adding Microsoft.

The roads of the future are preparing for a world in which more and more cars, buses and trucks will be driven without human intervention. The companies that will benefit from this scenario are today deploying the vehicles and components that will be able to perform this task, as well as collecting the data needed to feed the systems that will enable learning driving algorithms.Are you ready for a world of smart cars beyond Tesla?

The European Portfolio is made up of the 8 European stocks that we believe have the best revaluation prospects at the present time. The stock selection is made from a fundamental point of view but also taking into account possible catalysts in the short term (earnings, corporate moves, etc).

Permanent portfolio fund

Among the conservative investment strategies, the Permanent Portfolio model devised by Harry Browne stands out. It develops a passively managed asset allocation strategy constructed by components in such a way that it attempts to be an «all-rounder» portfolio capable of delivering good results when adverse economic conditions such as inflation, deflation or recession occur.

The components of the Portfolio are as follows, each equally weighted for as long as he holds the Portfolio: 25% in equities, which do well in times of booming economic activity. Harry recommends that an investor select three index funds to make up this portion of the portfolio. Although today we could replace this recommendation with a product that replicates the performance of the MSCI World Index, as in his model he advised that the components should «represent the entire market», without specifying whether this referred to the entire international stock market or just the U.S. market.